Share this article

There has been a massive growth of self-employment in the UK in recent years. Since 2001, self-employed workers in the UK now make up 15% of the working population.

This will only continue to grow as figures have almost tripled for self-employed workers over the age of 65 since 2001. The trend is also prominent in young people as the number of self-employed workers aged 16-24 has almost doubled since 2001.

Here we will explore different aspects of self-employment, including why it is so popular within the workforce:

A job for life?

The UK has seen a massive rise in self-employment. The numbers are astounding; since 2001 self-employment has risen from 3.3 to 4.8 million in 2017 according to the Office for National Statistics (ONS).

The surge in self-employment has boosted job growth overall as unemployment was at an all-time low in May 2018 at 4.2%. This is the lowest level since 1975.

Self-employment can be tricky to define as these individuals can be classed as entrepreneurs, contractors, freelancers and gig economy workers depending on their circumstances. However, zero-hour workers are not included as they usually have the same rights as a standard employee. If you wish to determine someone is self-employed or not you can classify them by answering the questions:

- Are they able to work for more than one client?

- Do they own their own business rather than work for an employer?

- Do they create their own work schedule?

- Are they responsible for providing their own equipment for the job?

- Can they approve prices for labour with clients?

Interestingly, the highest number of self-employed workers are aged 45 to 54. However, the growth of self-employment has occured the most rapidly in self-starters aged 65 and over. Since 2001 there has been an increase of 337,000 – this is a massive trend from 2001 to 2016 in the economy. With the retirement age constantly rising this will likely continue.

Not only is self-employment prominent in the older generations but 16 to 24-year-olds are the second fastest growing group of self-employed workers, with a total 181,000 self-employed professionals in 2016. This is an increase of 74% from 104,000 in 2001.

Popular careers

There are plenty of contracting careers in the self-employment workforce in the EU; in 2016 there were 33 million people who were self-employed.

With technology growing this is enabling self-employed workers to reach potential clients through online and digital platforms. Individuals are now able to reach wider audiences offering their services whilst travelling as a remote freelancer. Time is no longer an issue with advances such as Wi-Fi, FaceTime/Skype and the Cloud; there is now accessibility to areas that would have been difficult to target years ago.

The younger generation particularly can take advantage of being able to work where and when they want on projects that they are passionate about.

Popular industries for self-employed people

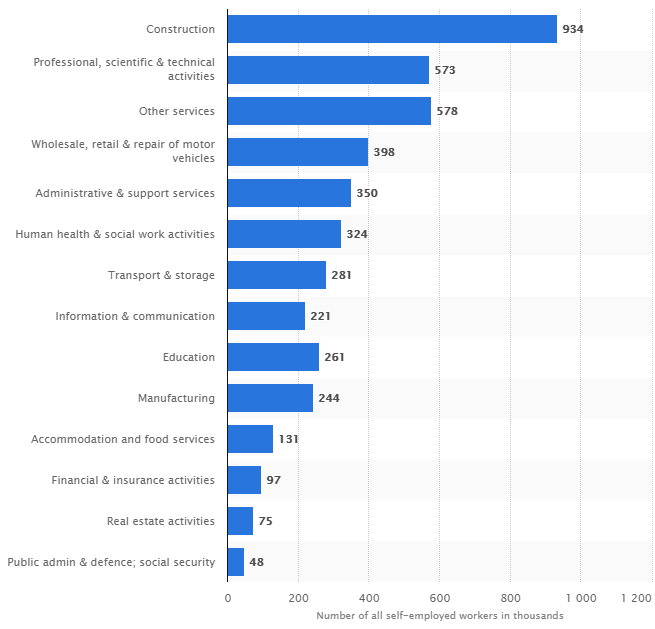

According to statistics from January 2018 to March 2018, construction workers accounted for 934,000 workers which is the highest proportion of self-employed people in the UK. This was followed by professional, scientific, technical activities and other services at 570,000. Then at 398,000 came workers of wholesale, retail and repair of motor vehicles. The lowest sector at 48,000 is public admin & defence and social security. The wide variety of sectors make self-employment appealing to a wide selection of workers hence why it is becoming so popular.

Growth of self-employment; representations among industries. Source: Statista.com.

Are self-employed workers protected?

Becoming self-employed is a great risk whether it be a success or failure.

Self-employed workers running their own business take responsibility for any financial losses or gains unless they set up and run their own limited company, which offers limited liability.

In any arrangement in which there’s a provision of services to a client by a self-employed person, a contract should be in place to set out terms and responsibilities with the client so they are protected against any fallout. However, in general self-employed workers do not have the employment rights that regular employees benefit from – this can be seen as an issue for some but many contractors see it as a small sacrifice in exchange for higher earnings and freedom.

Regardless, the government is currently looking at overhauling employment rights to give gig economy workers more protection. At the same time, legislation such as IR35 is constantly changing in order to generate tax revenue from self-employed people who work very similarly to regular employees.

Is there a gender pay gap amongst the self-employed?

Controversially, in 2016 men earned more in the UK than women regardless if they were in self-employment or were full-time employees.

With median weekly earnings coming out £120 higher for males compared to females, this shows that despite the increasing popularity of self-employment amongst both men and women, there is still a gender pay gap within the self-employed industry.

The worst off payees were female entrepreneurs working part-time earning £120 per week in 2016.

The self-employed sector is becoming a massive part of our workforce, especially amongst older and younger generations who are looking for more freedom and flexibility in their careers. It will be interesting in the years to come to see how the government manages this movement and how employment-related legislations will adapt to this.

We're regularly adding new, helpful content

The Churchill Knight blog is regularly updated with helpful content for contractors and freelancers – especially articles that answer the most frequently asked questions about umbrella companies! Please pop back shortly to see the latest articles written by Andrew Trodden (Marketing Manager) and Clare Denison (Marketing Executive).