Share this article

As a contractor payroll provider for over 20 years, we strive to educate contractors and the recruitment agencies that support them about tax avoidance schemes.

We put contractors first and want to spread awareness about the danger of tax avoidance schemes to help you protect your financial well-being.

Firstly – what is a tax avoidance scheme?

A tax avoidance scheme is a system that is set up to increase take home pay by avoiding tax, whether that be via offshore loan schemes, trusts, or job boards. Remember, there is a difference between tax avoidance and evasion – which could land you (and your recruitment agency) in even more trouble.

Although tax avoidance is technically legal, HMRC is cracking down on these schemes more than ever and targeting contractors for unpaid tax. The most famous recent case of HMRC going after unpaid tax is via the Loan Charge – whereby tens of thousands of contractors previously used (knowingly and unknowingly) loan schemes to get paid and will now have to repay the tax or face a penalty.

You need to be aware of all types of tax avoidance schemes so you can make your own educated choices on who you choose for a provider.

Spotting Tax Avoidance Schemes

The good news is that there are easy indicators that can help you spot and stay clear of tax avoidance schemes. Some of these tools and phrases that these schemes use will likely be very familiar.

‘90 percent take home pay’

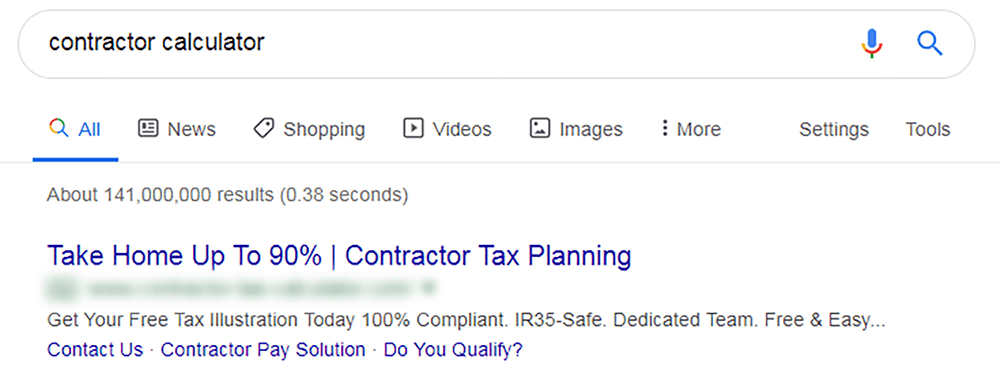

You may find adverts on Google search results that claim to offer 90% take home pay or more. However, even if you opt for the more tax-efficient limited company option where possible, 90% take home pay cannot be achieved in a compliant way.

With the basic rate of tax being 20%, this already leaves you at 80% take home pay before you consider legal tax saving options (which realistically won’t bring your take home pay higher than around 82-85% at the most).

Surprisingly, there are many companies out there who offer upwards of 90% take home pay – but this is too good to be true. We strongly advise you to avoid these companies and instead look for companies that have credibility, are based in the UK and are well-established.

‘Better than PAYE’

A quick search on Google for payroll companies will yield results from dodgy companies claiming to offer solutions that are ‘better than PAYE’. While the take home pay offered through these schemes might be higher than actual PAYE, that doesn’t mean they’re compliant or ‘HMRC-approved’ as they claim to be.

Unfortunately, there’s no real way of getting around the tax that you owe if you don’t want to risk being hit with a bill and additional penalties further down the line. However there are compliant umbrella companies out there that offer additional perks as an umbrella employee, and if running your own limited company is right for you there are more legal tax planning options available to you.

‘It’s perfectly legal’

Compliant providers are certainly entitled to reassure you that they are legal. However bearing in mind what you have already read about tax avoidance schemes, you should be wary of providers that go out of their way to make this statement or say it too much.

Tax avoidance schemes are technically legal based on the definition of tax avoidance, however they are not approved and HMRC does go after them and the people that used them. Therefore if you believe you are being referred to a tax avoidance scheme and are told that ‘it’s perfectly legal’, you should do some more research and find alternative options if required.

In the 2016/17 tax year HMRC only lost three out of 26 court cases to do with tax avoidance, and in March 2019 it published its win over promoter Hyrax Resourcing – which caused HMRC to be owed over £40 million in unpaid tax. As you can see, the risks of using such a scheme far outweigh the short-term benefits.

‘Our insurance will protect you – just in case’

While tax enquiry protection is available for some circumstances, this is mostly reserved for IR35 cases and only open to contractors operating as limited company directors or sole traders.

No insurance can protect you from being liable to pay tax avoided using an offshore tax avoidance scheme, trust or loan scheme. If a dodgy payroll provider has ever claimed to offer you insurance, it is effectively invalid.

‘We’re compliant with IR35 and HMRC-approved’

HMRC is very vocal about never having approved a loan scheme or tax avoidance scheme, so schemes claiming to be ‘HMRC approved’ are easy to spot and avoid.

Generally speaking, truly compliant providers don’t say ‘we’re compliant with IR35’, as there are too many factors to consider including the responsibility of stakeholders (end-clients, for example) outside their operations.

Many providers like Churchill Knight state that their operations are ‘fully compliant with HMRC’. Payroll providers and accountants can only rightfully claim to be HMRC-compliant if they are audited by an external organisation or accredited by trusted firms that recognise accountancy and payroll practices. Churchill Knight & Associates Ltd and Churchill Knight Umbrella Ltd are regularly audited for compliance.

Be careful when researching payroll providers and accountants

Now that you know how to spot a tax avoidance scheme, you should put in practice the guidelines we’ve provided to ensure you protect your hard-earned income. Not only is using a tax avoidance scheme likely to land you in financial trouble in the future, but it can also affect you professionally and personally as we’ve seen with the likes of the Loan Charge.

There are more effective (yet time-consuming) ways you can look into payroll providers to see if they are trustworthy:

- Look up their company information on Companies House (if they can’t be found there, they could be an offshore scheme)

- Check out the Director’s information on LinkedIn if possible

- Look for company reviews or discussion threads on the company on the ContractorUK Forum – savvy contractors are often quick to point out their experiences and awareness of non-compliant schemes

Look for a trusted provider

Instead of going through the hassle, you can choose an accountancy and payroll provider that’s proven their credibility in the industry. Churchill Knight has been working closely alongside recruitment agencies for over 20 years providing a wide range of compliant payroll solutions.

We’ll always be transparent about our services and let you know exactly how using our services could work for you. We always have our clients’ best interests at heart, and with our range of services we are sure to have an option that suits you. Get an instant take home pay calculation to learn more.

For more information on tax avoidance schemes, please read our short guide for contractors called: ‘How to spot a tax avoidance scheme‘.

How much could you take home with Churchill Knight?*

Calculate Your Take Home Pay

Editable content goes here...

* Calculator for illustration purposes only and uses assumptions. Limited figures based on 52 weeks, expenses £50 per week, £9,100 salary and accountancy fees included. As of 1st April 2023, there is no longer a single rate of Corporation Tax. The calculator uses assumptions and estimates and is designed to be accurate by individual circumstances will vary. Umbrella figures based on 52 weeks, £15 per week margin and holiday pay paid out. For a more accurate calculation tailored to your requirements, please contact Churchill Knight today by calling 01707 871 622 or contact us here.

We're regularly adding new, helpful content

The Churchill Knight blog is regularly updated with helpful content for contractors and freelancers – especially articles that answer the most frequently asked questions about umbrella companies! Please pop back shortly to see the latest articles written by Andrew Trodden (Marketing Manager) and Clare Denison (Marketing Executive).