Share this article

The Apprenticeship Levy officially came into effect on the 6 April 2017. Whilst the levy itself is only 0.5% of a company’s total salary expenditure, this could potentially cost recruitment agencies thousands of pounds. Our latest blog summarises the levy and how it might impact your recruitment agency.

Why did HMRC introduce the Apprenticeship Levy?

The government has been determined to increase the “quantity and quality” of apprenticeship schemes in the United Kingdom. In order to achieve this and create an additional 3 million apprentice positions by 2020, they have put an emphasis on employers to make a significant contribution.

If businesses spend their Apprenticeship Levy on training for apprenticeships, the government will provide additional funding. Therefore, the Apprenticeship Levy can provide a positive return in investment, as long as businesses take advantage of the opportunity.

What is the Apprenticeship Levy?

Every business in the United Kingdom will be subject to a 0.5% duty on their annual payroll bill, but there is a £15,000 allowance. Therefore, only businesses with an annual payroll of £3,000,000 or over will be required to pay an Apprenticeship Levy.

The government has released an online tool designed to help businesses work out their Apprenticeship Levy and their payment schedule.

An example of the Apprenticeship Levy

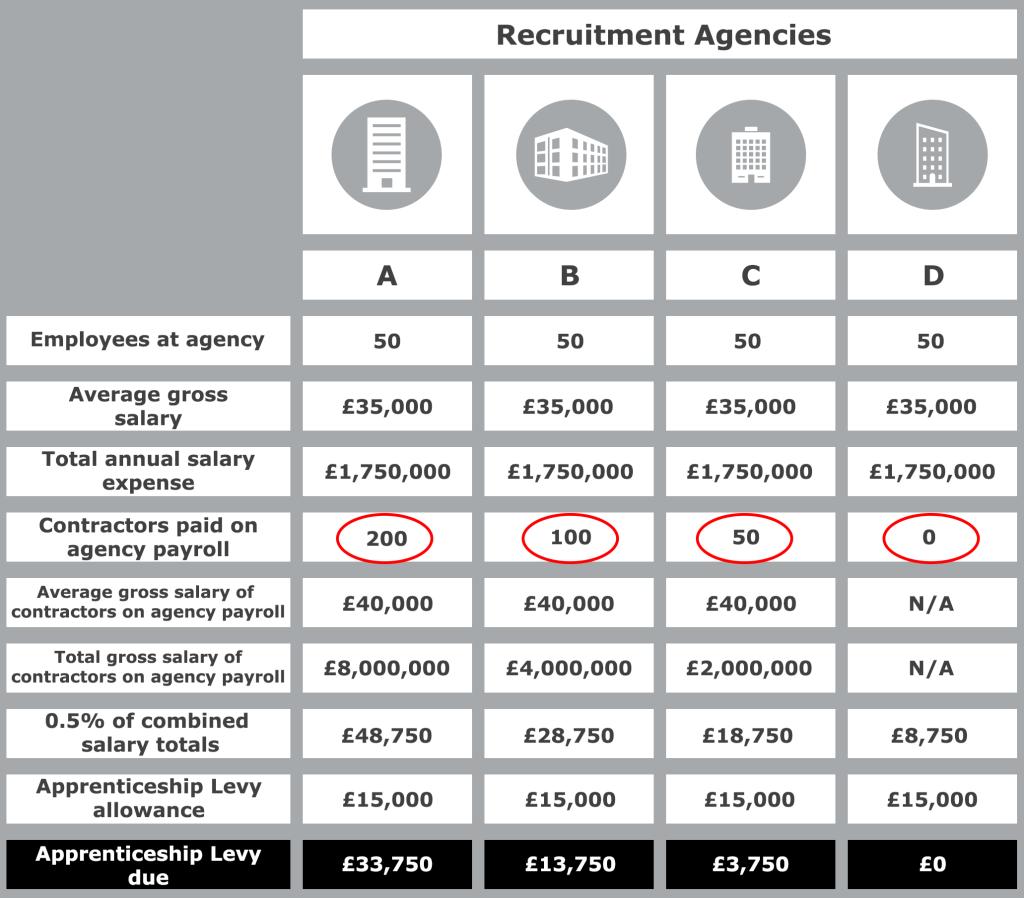

The Apprenticeship Levy will have a varying impact on businesses in the United Kingdom. We have produced the example below, focusing on four different recruitment agencies and summarising how the Apprenticeship Levy will affect each of them.

Recruitment agencies A, B, C and D all have fifty internal employees with an average salary of £35,000. The number of contractors on each of their payroll varies, resulting in each agency owing a different Apprenticeship Levy. Recruitment agency D has no contractors on its payroll and because their own annual salary expense is less than £3,000,000, they are the only agency in the example who are exempt from paying the Apprenticeship Levy.

How can recruitment agencies avoid paying the Apprenticeship Levy?

The recruitment industry will be heavily impacted by the Apprenticeship Levy because a significant number of agencies pay their candidates directly on their internal PAYE payroll. Companies that do this will have a large number of employees on their payroll and are therefore likely to qualify for the Apprenticeship Levy.

The Apprenticeship Levy could provide your recruitment agency with an opportunity to expand your workforce. If this is not something you are currently looking to do, have you considered removing your candidates from your internal PAYE payroll and suggesting to them that they start their own limited company or join an umbrella company?

If your candidates start their own limited company, you will be able to pay their company and remove them from your payroll. They will be able to legally maximise their take home pay by paying themselves a combination of salary and dividends. They will also be able to claim tax relief on business expenses.

Joining an umbrella company is another way your candidates can be paid for their contracting work. Using an umbrella company works in a very similar way to agency PAYE, but your candidates will be on the umbrella company’s payroll and not your own.

Make sure you are always up to date with the latest recruitment agency news

Churchill Knight & Associates Ltd is partnered with hundreds of recruitment agencies throughout the United Kingdom. We are a trusted contractor accountancy and umbrella payroll provider and have helped over 20,000 contractors get paid in full compliance with HMRC legislation since 1998.

There are numerous benefits available to recruitment agencies who partner with us, including your own dedicated account manager, training from our in house specialists and access to exclusive industry news and legislation updates.

You will be in safe hands with Churchill Knight as we are accredited by Professional Passport. To add Churchill Knight to your Preferred Supplier List, or to ask our agency consultants any questions, please call 01707 671645, or email agency@churchill-knight.co.uk.

We're regularly adding new, helpful content

The Churchill Knight blog is regularly updated with helpful content for contractors and freelancers – especially articles that answer the most frequently asked questions about umbrella companies! Please pop back shortly to see the latest articles written by Andrew Trodden (Marketing Manager) and Clare Denison (Marketing Executive).