Share this article

‘Off-payroll working in the private sector’ is fast approaching and as a recruitment agency you should have a strategy in place to minimise its impact on the business, consultants and your candidates. As a compliant and well-established umbrella company, Churchill Knight Umbrella has made it our priority to educate and give recruitment professionals the tools to safeguard their agency.

Churchill Knight is hosting a free seminar in London on Thursday 14th November 2019 with Professional Passport. The seminar is exclusively for recruitment professionals and their private sector end-clients. It will cover the upcoming off-payroll legislation changes and how to safeguard your business. To attend our seminar, please complete the short registration form here. Make sure you confirm your place quickly – they’re already going fast.

Understanding the legislation

What is ‘off-payroll in the private sector’ legislation?

Off-payroll working rules were introduced to the public sector in April 2017. The legislation meant that contractors and temporary workers operating in the public sector were no longer able to determine their IR35 status. Instead, the responsibility was passed to the public sector organisation they were working for – the end-client. Once the end-client had made their assessment, it became the responsibility of the fee-payer to ensure the correct tax and National Insurance Contributions (NICs) were made at source before the temporary workers received their net pay.

This legislation is now being adapted and rolled out to the private sector in April 2020.

How do contractors get paid?

Firstly, you need to identify the various operating methods that your off-payroll workers use for their payroll. Understanding these methods is vital so that you can plan for April 2020 accordingly.

The most common types of contractor payroll include:

- Operating through a personal service company (PSC)

- Using a PAYE umbrella company

- Using an agency’s PAYE

- Operating as a sole trader

- CIS payroll services

You should already have a list of every private sector contractor and temporary worker using your agency, including information on their potential IR35 status post-April 2020, their contract end date and the payroll method they use. If you haven’t got this data to hand, you should collate it as a priority.

Once you understand how your workers are getting paid, you should also identify:

- The impact each payroll structure will have on your agency when the changes come in, both in terms of financial risk and implications on key projects

- The various types of projects and work undertaken by contractors, for which the working circumstances will need to be assessed

- Which contractors are “high risk” – this is explained in the next section.

Which contractors are “high risk”?

Although the legislation comes into effect on 6th April 2020, contracts that end before this date should be carefully looked at. If a contract finishes in March 2020 but payments are made after 6th April – an IR35 assessment must be undertaken and if this results in a deemed payment, the correct tax and NICs must be deducted. Failure to do so could result in non-compliance with the rules. Even if a contract finishes before 6th April 2020, all payments should be settled before this date. If they are not, your agency will be liable to pay the employment costs. This further reiterates the importance of reviewing every contract now – and correctly – before it’s too late.

As part of your preparation, you should determine which contractors fall into the following categories:

- Current contract finishes before April 2020 – If a contract comes to an end before April 2020, you are not at risk, providing invoices and payments are settled before April.

- Contract is up for renewal before April 2020 – The contract must be thoroughly reviewed when up for renewal and an accurate IR35 assessment is required by the end-client. If an inaccurate assessment is made and you pay contractors unlawfully, your agency could be held accountable.

- The current assignment finishes after April 2020 – There is high risk associated with this type of scenario. You must ensure the contract is assessed as soon as possible and ensure the contractor is paid correctly. It may be in the end-client’s best interest to give notice of contract termination early (per the terms) and ensure payments are settled before April 2020. Then, a new contract and new working circumstances can be developed for “the new world”.

- The assignment is due to start on or after 6th April 2020 – If this is the case, reassess the contract and ensure the IR35 status is fairly determined.

IR35 Reviews

Review each contract

Off-payroll in the private sector does not mean the end of contracting outside IR35 through a PSC. However, we cannot emphasise enough how important it is for each and every contract to be accurately reviewed. We suggest you work with end-clients and ensure they are comfortable with their upcoming responsibilities. There are plenty of IR35 tax investigation specialists out there who can provide expert assistance and advice.

Review the actual working practices

It is important to remember that where a contract is deemed “outside IR35” based on contractual terms, the actual working practices must also be “outside IR35”. This reiterates the importance of working with your clients and ensuring each contract is reflective of the duties your candidates carry out on a daily basis.

Involve contractors in assessments

It is highly recommended that end-clients involve contractors in IR35 assessments to allow them to accurately determine their status in theory and in practice. It will also help the end-client back up their decision and the process used to determine the contractor’s status if they are required to by HMRC.

Useful online tools, such as IR35 Shield, automatically involve the contractor in the IR35 assessment process as they are required to complete a few questions about their role and working circumstances.

Making IR35 Assessments

There are many factors that must be taken in account when determining whether or not a contract is inside or outside IR35. However, the three most commonly used areas to determine status are:

- Supervision, Direction or Control (SDC) – Genuine contractors are expected to have total control over their work assignments, nor can they be under the supervision or direction of anyone they work with.

- Substitution – If your candidates have to complete all of their assignments personally and are not able to send a qualified substitute on their behalf, this implies they are more likely to be seen as an employee in the eyes of HMRC.

- Mutuality of Obligation (MOO) – Contractors outside IR35 have no obligation to continue working for their client once their assignment is complete. This also means the client has no obligation to offer your candidates any more work following the completion of the agreed contract.

Blanket IR35 assessments are not legal

End-clients who decide to take a blanket approach to their IR35 assessments are not acting lawfully. The legislation itself states that reasonable care must be taken when deciding whether a contract is inside or outside IR35. Therefore, simply deciding that a group of temporary workers are inside IR35 to try and reduce any risks that may arise due to inaccurate assessments is prohibited.

Financial implications

Off-payroll in the private sector will have significant financial implications on the whole contractor supply chain. As a result, it is important that your agency is up to speed with these implications and a plan is in place.

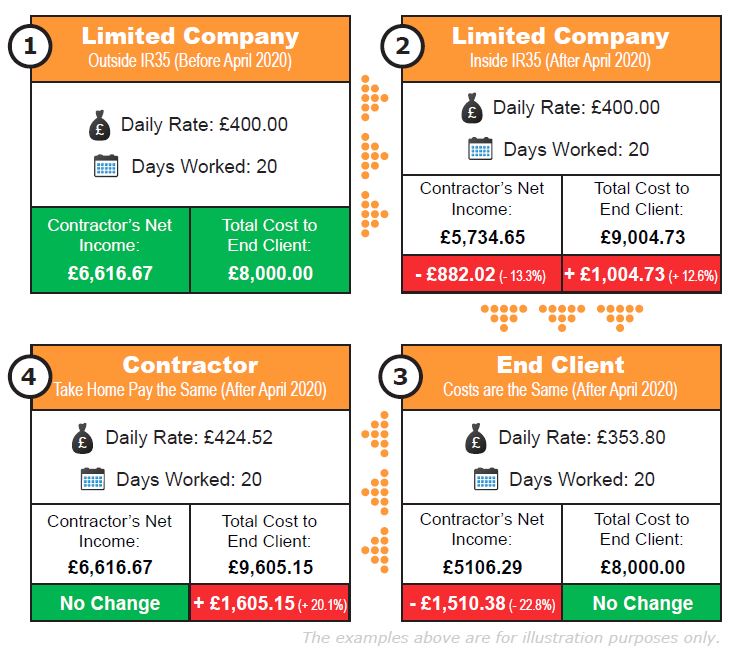

Contractors in the private sector could see their take home pay decrease by up to 30 percent as a result of being assessed as inside IR35. Your agency should consider renegotiating with end-clients to determine if they are prepared to increase the rates of contractors deemed inside IR35 to compensate for the increase in tax and NI.

There is a risk that if contractors are suddenly faced with substantial decreases in their net pay, they may decide to leave their current assignments or decline a contract renewal when the contract is complete. This could result in a skills shortage and may put existing projects in jeopardy.

To minimise this risk, it may be possible to adjust contracts and change working arrangements to ensure existing and future contracts are outside IR35. Work closely with your clients now to ensure they are able to have access to highly skilled contractors.

As mentioned earlier, there are plenty of IR35 specialists in the UK. Engaging with these companies could be expensive however, as they are likely to charge per contract.

It is important to analyse all the potential financial implications of off-payroll legislation well in advance. This includes determining any extra tax and NI required from each worker deemed inside IR35, assessing projects that may potentially need cancelling or having the budget revised, or the costs of changing working conditions for contract roles to be ‘outside IR35’.

The graphic below shows some examples of the cost implications that contractors and private sector organisations will face.

Use off-payroll in the private sector to your advantage

There is a lot of negativity surrounding off-payroll legislation. However, the legislation can also create exciting opportunities for your business.

Whilst a majority of your end-clients may be ready for the changes or are in the middle of implementing a plan, many will be struggling to come to terms with what lies ahead. Now is the perfect time for you to contact them and offer a solution. End-clients will soon be responsible for IR35 assessments and you can help them understand how to approach it when the time comes, and which contracts may need amending.

Keep up-to-date and come along to our free London seminar

To keep our recruitment partners up to date with the latest developments in IR35 and off-payroll legislation, Churchill Knight has been hosting a series of seminars with our accreditation provider Professional Passport. So far, the feedback we have received from these seminars has been excellent and we are hosting another on Thursday 14th November 2019.

Please register here to attend our free seminar and find out more about off-payroll legislation and what your agency should be doing to prepare.

We're regularly adding new, helpful content

The Churchill Knight blog is regularly updated with helpful content for contractors and freelancers – especially articles that answer the most frequently asked questions about umbrella companies! Please pop back shortly to see the latest articles written by Andrew Trodden (Marketing Manager) and Clare Denison (Marketing Executive).