When did the Agency Workers Regulations (AWR) start?

The Agency Workers Regulations (AWR) came into effect on 1 October 2011.

Scope of the AWR

The AWR affect the following:

- Temporary agency workers who have an employment contract or contract for services with an agency but works temporarily for and under the direction of the hirer.

- Individuals/companies who supply temporary workers to work temporarily for and under the direction of a hirer, also known as Temporary Work Agencies (TWA).

- Hirers book agency workers via TWA and are responsible for supervising and directing the agency worker.

There is a tripartite relationship between these 3 parties.

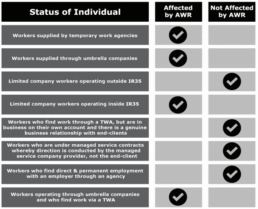

Workers more specifically affected by the AWR

What does the AWR set forth?

- Any temporary worker working for a company after 12 weeks (Qualifying Period), on the same job role, with the same hirer, will have equal working conditions to that of a permanent employee in the same job, as if he had been recruited directly like an employee for the same job in the company.

- The 12 weeks can be accumulated even if a worker works for only a few hours during a week.

Equal working conditions would include the following:

- Fair treatment by the hirer.

- Access to collective facilities (e.g. canteen, crèche, recreational room, local pick up and drop off transportation services, food & drinks machines, car parking).

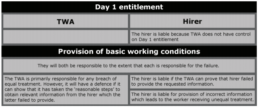

- Access to collective information on internal job vacancies from Day 1 of their assignment (Day 1 entitlement).

- In relation to pay (e.g. overtime payments, allowances, payment for annual leaves, bonus, lunch vouchers, childcare vouchers, paid time off for ante-natal appointment).

- Equal working time hours, rest periods in addition to existing rights under the Working Time Regulations 1998.

What benefits are agency workers not entitled to?

- Occupational pension schemes

- Share schemes

- Enhanced occupational sick pay

- Redundancy pay

- Paternity or maternity pay

- Company performance bonuses

- Non-cash awards

- Salary advances or loans

- Additional discretionary or non-contractual payments

- Company car

Important responsibilities of the different parties

TWA

- Health & Safety: If the nature of the assignment poses a health & safety risk, the TWA will need to ask the hirer to perform a workplace risk assessment and make reasonable adjustments (e.g. expectant mothers).

- If reasonable adjustments cannot be made, the TWA will need to seek alternative suitable work for the worker with another hirer, which is paid at least at the same rate.

- For each vacancy, a TWA receives from a hirer, the TWA must record all details about the vacancy before the introduction or supply of a worker takes place, in order to be compliant with the Gangmasters Act and the Conduct of Employment Agencies and Employment Businesses Act (e.g. check the identity of the hirer, nature of business, location, duration of assignment, job role).

- The TWA needs to ask the hirer for information about pay and other basic conditions when it is clear that the worker will be in the same job with the same hirer for more than 12 weeks.

Hirer

- Where a risk assessment is required, the hirer will need to carry one and where risks are identified, the hirer is obliged to make adjustments to remove the risk.

- If a risk assessment is not possible, the hirer should inform the TWA, who will then need to look for an alternative work.

- It should provide the TWA with updated information about its terms and conditions so that the TWA can ensure that the worker receives equal treatment.

- It should ensure that all agency workers are able to have access to the facilities offered to its employees and view vacancies from Day 1 of their assignment with the hirer.

- It should provide the TWA with the required details in order to comply with the AWR if an agency worker completes 12 weeks in a given job. As the entitlement to equal treatment begins in week 13, the information should be provided promptly when it is clear that the assignment will last for more than 12 weeks (e.g. basic pay, any overtime payments etc.)

Worker

- The TWA is likely to ask for details of the worker’s work history to help establish when the worker is entitled to equal treatment and he is required to provide the data.

In the event of a claim from the worker, who is liable?

Anti-Avoidance Provisions

- Hirers and TWAs should also be aware of anti-avoidance provisions which prevent assignments from being structured in a way so as to prevent an agency worker from reaching the Qualifying Period. Having said that, anti-avoidance provisions do not force a hirer to engage agency workers beyond 12 weeks. However, TWAs and hirers should be aware that the law addresses situations where the patterns of assignments are designed to deliberately deprive a worker of his entitlement.

- TWAs or hirers are liable for a fine up to £5000 should they artificially circumvent the patterns of assignments to prevent the agency worker from accruing 12 weeks.

Example of an artificial arrangement

- Where a hirer is part of a larger group and each company has its own separate legal entity, an agency worker is moved back and forth between the different legal entities with the intention to deprive the worker from receiving equal treatment.

This guide is being provided to you solely for your personal information. It is not intended for distribution to the press or any other media and may not be reproduced or redistributed by mail, facsimile, electronic or computer transmission or by any other means to any other person or body without the express written permission from a Director of Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited.

This guide is not a substitute for specific legal, accounting or other professional advice or opinions on related matters and issues that arise and should not be taken as providing specific advice on any of the topics discussed.

The information contained herein has been prepared by using sources believed to be reliable. Whilst reasonable care has been taken to ensure that the facts stated herein are accurate, no representation or warranty, express or implied is made by Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited, with respect to completeness, correctness, reasonableness or accuracy of any information and opinions contained herein.

Without limiting the generality of the foregoing, liability for any negligent or innocent statement or misstatement in respect of the contents of, or any omission from this guide are hereby expressly excluded. Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited has no obligation or liability whatsoever with respect to the information provided or any action or inaction of Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited or the recipient with respect to such information.

The Churchill Knight Group consists of Churchill Knight & Associates Ltd, Churchill Knight Umbrella, Bluebird Accountancy, Bluebird Umbrella and Umbrella Company UK.

Compliance will always be our priority

Churchill Knight Umbrella is proud to be one of the first UK umbrella companies with both an accreditation from the FCSA and SafeRec Certification. We're partnered with hundreds of agencies who equally value compliance and service, and we ensure all of the temporary candidates (contractors and freelancers) that are referred to us receive an exceptional payroll experience - from the initial calculation we provide them to processing their pay for the first time.

The FCSA is the UK’s leading professional body committed to ensuring the compliance of the supply chain of temporary workers.

SafeRec is revolutionary, and having a PSL exclusively composed of SafeRec certified umbrella companies will protect your business and candidates.