What is The Apprenticeship Levy?

From April 2017, businesses will be required to pay the new Apprenticeship Levy – a duty introduced by the government to improve the quantity and quality of apprenticeship schemes. A 0.5% duty will be applicable to every business, but there will be a £15,000 allowance. Therefore, businesses will only be required to pay an Apprenticeship Levy when their annual payroll is over £3,000,000.

How will recruitment agencies be affected by the Apprenticeship Levy?

Recruitment agencies could potentially find themselves with an Apprenticeship Levy costing thousands of pounds. Contractors on the payroll of an agency will contribute towards the agencies annual salary expense and could heavily impact the total duty owed.

The Apprenticeship Levy could potentially cost your recruitment agency thousands of pounds. Keep reading to see an example.

An example of the Apprenticeship Levy

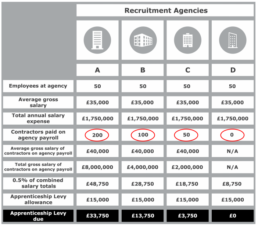

Recruitment agencies A, B, C and D all have fifty internal employees with an average salary of £35,000. The number of contractors on each of their payroll varies, resulting in each agency owing a different Apprenticeship Levy. Recruitment agency D has no contractors on its payroll and because their own annual salary expense is less than £3,000,000, they are the only agency in the example who are exempt from paying the Apprenticeship Levy.

What should recruitment agencies do?

Once you have declared your levy to HMRC, “you will be able to access funding for apprenticeships through a new digital apprenticeship service account” (HMRC). Therefore, hiring an apprentice may be an ideal solution for your business and will ensure you get a return on your levy payments.

Regarding the levy itself, it may be more cost effective for your business to pay your candidates directly via their own Personal Service Company (PSC) because this way they will not be on your payroll. The same applies if you outsource your payroll requirements to an umbrella company, such as Churchill Knight Umbrella.

This guide is being provided to you solely for your personal information. It is not intended for distribution to the press or any other media and may not be reproduced or redistributed by mail, facsimile, electronic or computer transmission or by any other means to any other person or body without the express written permission from a Director of Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited.

This guide is not a substitute for specific legal, accounting or other professional advice or opinions on related matters and issues that arise and should not be taken as providing specific advice on any of the topics discussed.

The information contained herein has been prepared by using sources believed to be reliable. Whilst reasonable care has been taken to ensure that the facts stated herein are accurate, no representation or warranty, express or implied is made by Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited, with respect to completeness, correctness, reasonableness or accuracy of any information and opinions contained herein.

Without limiting the generality of the foregoing, liability for any negligent or innocent statement or misstatement in respect of the contents of, or any omission from this guide are hereby expressly excluded. Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited has no obligation or liability whatsoever with respect to the information provided or any action or inaction of Churchill Knight & Associates Ltd/Churchill Knight Umbrella Limited or the recipient with respect to such information.

The Churchill Knight Group consists of Churchill Knight & Associates Ltd, Churchill Knight Umbrella, Bluebird Accountancy, Bluebird Umbrella and Umbrella Company UK.

Compliance will always be our priority

Churchill Knight Umbrella is proud to be one of the first UK umbrella companies with both an accreditation from the FCSA and SafeRec Certification. We're partnered with hundreds of agencies who equally value compliance and service, and we ensure all of the temporary candidates (contractors and freelancers) that are referred to us receive an exceptional payroll experience - from the initial calculation we provide them to processing their pay for the first time.

The FCSA is the UK’s leading professional body committed to ensuring the compliance of the supply chain of temporary workers.

SafeRec is revolutionary, and having a PSL exclusively composed of SafeRec certified umbrella companies will protect your business and candidates.