Introduction

Thank you for taking the time to look at our Ultimate Guide to Umbrella Companies. With the demand for payroll providers increasing, we decided that it is important contractors and freelancers understand Umbrella Companies so that if they need to use one in the future, they know what to expect.

If you are interested in using a compliant umbrella company with FCSA accreditation and SafeRec certification, you’ve come to the right place. Churchill Knight Umbrella is a leading UK-based umbrella with a focus on customer service. To request an umbrella company calculation, click here. Alternatively, please call our friendly team on 01707 871622.

What have we included in the ultimate guide to umbrella companies?

Keep scrolling to find in-depth answers to the following frequently asked questions about umbrella companies.

- Umbrella Companies – an overview

- How do umbrella companies work?

- What do I need to do if I register with an umbrella company?

- What is supervision, direction, or control?

- How do you know if an umbrella company is compliant?

- How to spot a tax avoidance scheme

- The dangers of using a non-compliant payroll provider

- The advantages of using an umbrella company

- The disadvantages of using an umbrella company

- What is IR35?

- Off-payroll legislation (private and public sector)

- Do I need to submit a personal tax return if using an umbrella company?

- Understanding an umbrella company payslip

- Umbrella Company – Frequently Asked Questions (FAQ)

- Why should you use Churchill Knight Umbrella for your payroll?

Umbrella companies - an overview

Umbrella companies are generally regarded as the easiest method for temporary workers to get paid – but do you know how they work?

An umbrella company is a PAYE payroll provider for contractors and freelancers. When you register with an umbrella company, you become an employee of theirs and will get paid via PAYE – just as if you were in a permanent role. You will work for your end client as normal but will be required to send your signed timesheets to your umbrella company – so that they know how much to pay you. You will then receive your salary, minus tax, National Insurance Contributions (NICs) and a few additional deductions.

Don’t believe the negative press

There is often a misconception that umbrella companies are confusing and sometimes unethical. Providing you choose a compliant provider, you have absolutely nothing to worry about. One of the most important things to remember about umbrella companies is that providing they are compliant, your take home pay should never really vary – regardless of the umbrella company you use.

The only deduction on your payslip that will vary amongst providers is the umbrella company margin (the financial amount they deduct to cover the administration of conducting your payroll). The margin that umbrella companies charge will typically be between £15 and £30 per week.

It is also worth remembering, some leading umbrellas offer more than just payroll and their service may include free insurance cover, Same Day Faster Payments, and more!

Why do recruitment agencies require temporary workers to use umbrella companies?

Recruitment agencies will often require their candidates to work via an umbrella, rather than pay them directly through their own company’s PAYE. This is because umbrella companies can offer additional extras that may be required in order for their candidates to do their job, such as insurance.

Initially, registering with an umbrella company may sound stressful, but providing you are speaking to respectable and established firms, you can be signed up and ready to go in little over 10 minutes.

You may be better suited to a limited company

Umbrella companies are the easiest way for contractors to get paid, but not necessarily the most tax efficient. If you are a contractor or freelancer working outside of IR35 legislation, it may be more beneficial for you to set up and become the director of your own limited company. More information on IR35 legislation (also known as off-payroll) is available further on in this guide.

All the information you’ll ever need

Our Ultimate Guide to Umbrella Companies has been created to provide contractors and freelancers with all the information they’ll ever need about umbrella companies. If you have any additional questions about umbrella companies, please give our friendly team a call on 01707 871622 and we’ll be happy to help.

How do umbrella companies work?

Umbrella companies are often seen as being confusing and a complicated option to use if you are not familiar with how they work. However, using an umbrella company is the easiest and most hassle-free way to get paid as a contractor or freelancer.

So how does an umbrella company work? Below is a breakdown of how umbrella companies work and the roles of you (the contractor or freelancer), your umbrella company (such as Churchill Knight Umbrella), your recruitment agency and your client.

Who enters into an overarching agreement?

When you work through an umbrella company, you, your recruitment agency, end client, and umbrella company enter into an agreement. Your client will pay your recruitment agency your salary and this will then be transferred from the agency to your umbrella company. Your umbrella company will make all the relevant tax and National Insurance Contributions (NICs) deductions and pay your net salary directly into your bank account.

Registering with an umbrella company

Registering with an umbrella company could not be easier. Contact the umbrella company and let them know that you are considering signing up to their service. If you have any queries, they will be happy to answer them before you begin the sign-up process.

The whole process should take no longer than 15 minutes and can be done over the phone or via an online form.

Welcome to your umbrella company

Once you have completed the sign-up process, you will receive a welcome email from your umbrella company. This will explain the next steps you need to take in order to get set up successfully and receive your pay on time.

The umbrella company is now seen as your employer

When you sign up to an umbrella company, they will be seen as your employer – for tax purposes. You will be paid via Pay As You Earn (PAYE), exactly the same as someone who is employed on a full-time basis. The umbrella company must follow HMRC’s tax rules and regulations and will make the deductions from your salary accordingly. You will also receive a payslip which will show what deductions have been made – similar to a permanent employee.

Complete your timesheets and submit them

One of the benefits of working through an umbrella company in comparison to setting up your own limited company is that there is very little ongoing administration involved.

To ensure you receive your salary on time you will need to submit a timesheet to your recruitment agency or umbrella company, each week or month. Make sure the timesheet clearly shows the hours you have worked and is signed. You will then need to send your timesheet to your recruitment agency and umbrella.

What happens after you submit your timesheets?

There are two processes that can happen after you submit your timesheets in order for your payment to be processed and for you to be paid.

The first process is self-billing and this is the most popular payment structure that agencies adopt. It standardises their processes and leaves very little room for error because the timesheets and payment information are all pre-approved. As part of a self-billing arrangement, once your timesheets have been submitted to your recruitment agency and signed by your end client, your agency will produce a self-billed remittance. The self-billed remittance will detail when and how much you are due to be paid and this will be sent to your umbrella company who will then pay you.

The second process is non-self-billing and this requires you to send your timesheets to both your recruitment agency and umbrella company. Once your timesheets have been received by your umbrella company, they will raise an invoice to your agency. Your recruitment agency (who will already have raised an invoice to your client) will send your pay to your umbrella company. Once your umbrella company has received your salary, they will pay it into your bank account.

Your umbrella company will make the relevant deductions

Your chosen umbrella company will process the payment once it has been received from your recruitment agency and will make the relevant deductions. The deductions are the umbrella company’s margin, tax, National Insurance and Apprenticeship Levy contributions.

You will now be paid and receive your payslip

After your umbrella company has received your pay from your recruitment agency, they will make the relevant tax and NI deductions, and pay your net salary directly into your bank account. You will also receive a payslip which will show you exactly what deductions have been made and how much you are due to receive.

Umbrella companies can offer you more than just a payroll service

Umbrella companies can offer more than just a payroll processing service and added extras vary from provider to provider. Common benefits include:

- Employee benefits – Maternity Pay, Paternity Pay and Sick Pay

- Free insurance – Employers Liability Insurance, Public Liability Insurance and Professional Indemnity Insurance

Additionally, as a Churchill Knight Umbrella employee there are a host of benefits you will receive. Please click here to find out more.

Churchill Knight also provide a salary sacrifice service – the perfect way to boost your personal pension pot while using an umbrella company. Click here for more information.

What do I need to do if I register with an umbrella company?

Umbrella companies employ contractors using Contracts of Employment which means the umbrella company is seen as your employer – despite you not directly working for them. This means the umbrella company is responsible for issuing invoices for the work you do for your client, calculating and paying your tax on your behalf and paying your salary into your bank account (via PAYE).

Submit your timesheets each week

As an umbrella employee, you are required to submit a timesheet each week which shows all the hours that you have worked. This will need to be signed by your line manager or client. It will also show any expenses you are entitled to claim. Your umbrella company will invoice your client/agent for the work you have done. Once you have submitted your timesheet, you can sit back and relax!

What is supervision, direction, or control?

Supervision, Direction and Control (SDC) was brought in to limit the number of umbrella contractors able to claim subsistence and travel expenses. The legislation came into effect on 6th April 2016. Continue reading for a breakdown of what SDC is and to discover whether or not you are subject to it.

Please note – it is unlikely that contractors and freelancers are not subject to SDC, and therefore, most compliant umbrella companies will not allow anyone to claim travel and subsistence expenses anymore.

What does SDC stand for?

The following definitions for Supervision, Direction and Control are:

- Supervision – Someone is monitoring and overseeing the work you are doing to ensure it is completed to the required standard. It is also considered supervision if someone is helping you in order to develop your knowledge and skills.

- Direction – Someone is giving instructions or guidance as to how the work should be carried out. Someone giving direction is also often coordinating the work.

- Control – Someone is dictating how the work should be carried out and what work needs to be done. This also includes having the ability to move a contractor from one job to another.

What does SDC mean for contractors?

The legislation was brought into effect because HMRC believed there were contractors taking advantage of tax benefits working through umbrella companies, when in fact they were being treated the same as employees in permanent positions. The contractors claiming tax relief were deemed to be the same as permanent employees but had access to unfair tax benefits. Therefore, HMRC introduced SDC to stop this abuse. The introduction of SDC has meant a substantial decrease in the number of contractors working through umbrella companies and being able to claim relief on subsistence and travel expenses.

Subsistence expenses

Subsistence expenses include:

- Food and drink

- Accommodation

These type of expenses may have been incurred on a business trip for an end client.

Travel expenses

Travel expenses might have included one of more of the following:

- Journeys to and from a worksite (excluding your normal commute)

- Travel between a temporary worksite and your home

- Travel which is required for you to do your assignment

How do you assess your SDC status?

When you register with an umbrella company, they will offer you advice as to whether or not you are affected by SDC. However, because you are classed as an employee of the umbrella company, there is very little chance that you would be exempt from SDC as this is part and parcel of being employed by an umbrella company.

What happens if you are subject to SDC?

Unfortunately, if you are subject to SDC (which will be true in most cases) it means you are unable to claim tax relief on any subsistence or travel expenses. In rare instances, mobile workers who pass an SDC test may be able to claim expenses – but the majority of umbrella companies do not offer this option.

Why should you still consider using operating through an umbrella company?

Whilst it is still true that contracting through a limited company is the best way to maximise your take home pay (when you are able to operate outside IR35) there are plenty of benefits for contractors working through an umbrella company, depending on your chosen provider:

- Free insurance – Professional Indemnity insurance, Public Liability insurance, and Employers Liability insurance

- Access to employee benefits – Maternity Pay, Paternity Pay and Sick Pay

- Minimal ongoing administration – you just have to submit your weekly timesheets to your umbrella company

- Compliance – Compliant umbrella companies will deduct the correct amount of tax and National Insurance Contributions

- Dedicated Account Management – Ensuring communication is easy

Can you claim expenses with an umbrella company?

Remember – umbrella workers are rarely exempt from Supervision, Direction and Control and therefore most umbrella companies will not process travel and subsistence expenses as of April 2016.

How do you know if an umbrella company is compliant?

Contractors who do not have a good understanding of HMRC’s tax rules and regulations are being caught out by non-compliant umbrella companies who are claiming they can retain up to 90% of their salary after tax deductions. However, this is simply not possible if the company is compliant. With lots of different payroll providers available, how do you know which companies are safe to use?

Compliant umbrella companies follow HMRC’s tax rules and regulations

As you are employed by the umbrella company, you will be taxed via PAYE. Income Tax is applied to your salary depending on the tax bracket you fall into at either a basic rate (20%), higher rate (40%), or additional rate (45%) on all income you receive above the personal allowance. National Insurance Contributions (NICs) are also due on all earnings above the NIC threshold at either 8% or 2%. This means you can expect to retain 60-70% of your earnings. You will receive a payslip which will show you all the deductions that have been made and how much you will be paid into your bank account.

Checklist to make sure your umbrella company is compliant

It is extremely important that you use a compliant umbrella company or accountant to ensure you pay the correct amount of tax. Otherwise, you could be seen as committing tax avoidance/evasion and you will be required to pay back all of the tax that you owe, as well as facing penalties and unlimited fines.

Use the checklist below when deciding which payroll provider or contractor accountant to use:

- Are they FCSA accredited?

- Make sure that they are owned and run by industry professionals who have plenty of experience and knowledge about the contractor market.

- Check that they have a good reputation within the industry.

- Do they offer realistic take home pay projections that are compliant with UK tax law?

- Can they provide you with important information about how to legally comply with UK tax laws and regulations – specifically those relating to contractors?

- Make sure they have not been assigned a Scheme Reference Number (SRN).

- Do all of the umbrella company’s activities take place in the UK?

- Do they work with other companies in the industry (such as advisors and insurance providers) who have also got positive reputations?

- Do they publish content on their website or blogs which explain the importance of compliance and the risks associated with tax avoidance?

- Are they accredited by reputable professional bodies, such as Professional Passport or FCSA?

Tax avoidance is serious…

Using a non-compliant umbrella company could land you in serious trouble with HMRC and you may be required to pay back every penny of tax they believe you have under-paid?

How to spot a tax avoidance scheme?

A contractor who operates through a legitimate and compliant umbrella company can expect to retain 60-70% of their salary after the relevant tax and National Insurance Contributions (NICs) have been made. If a company is claiming you can retain up to 90% of your salary, it is most likely a tax avoidance scheme and you should avoid it at all costs.

What is a tax avoidance scheme?

A tax avoidance scheme operates with the sole intention of maximising contractors’ take home pay as a result of paying lower amounts of tax and NICs. Umbrella companies that promote tax avoidance schemes claim that tax regulations do not apply to the different payment options as salaries are sent via credit, loan schemes or something similar. However, this is not the case according to HMRC as the payments are no different to normal income and therefore tax and NICs still apply.

We have outlined a few examples of some of the most common types of tax avoidance schemes:

- Job boards – the contractor will receive a minimum wage and tax and NI deductions will be applied to this. They will then receive the rest of their salary as loyalty points for a job board, which they can exchange for tax-free cash.

- Pension schemes – part of the contractor’s salary is sent overseas and paid into a pension pot. The full amount can be collected (tax-free) at a later date.

- Loan Schemes – contractors will receive a minimum wage salary which will have tax and NICs deducted, and then they will receive the rest of their salary as a tax-free loan. These are unethical because the loans are not expected to be paid back.

On a payslip, the larger payments which are shown as something other than pay (job boards, pension schemes, loan schemes) will likely be coming from overseas and from a different bank account to the smaller payments (pay). Therefore, only a small amount of the contractor’s salary is being taxed and the rest is not. In the eyes of HMRC, this is tax avoidance.

How to spot a tax avoidance scheme

There are a few tell-tale signs which will help you to spot a tax avoidance scheme:

- The company’s registered address is outside of the UK.

- The company claims that payment via a loan scheme, job board points, pension scheme of refunded credit is not subject to tax and NI deductions.

- You will be paid a small amount of your salary with the tax and NI deductions applied and the rest in something other than regular pay which will not be taxed.

- The company claims that you can legally take home up to 90% of your salary after tax and NI deductions have been made.

Why are tax avoidance schemes not compliant?

If you are using a compliant umbrella company you can expect to take home 60-70% of your salary after the correct deductions have been made. This is because the basic rate of Income Tax is 20% and NICs are also due on all earnings above the NIC threshold at either 8% or 2%. Therefore, if you are being quoted take home pay in excess of 80%, the umbrella company is probably not legitimate.

Penalties for using a tax avoidance scheme

If HMRC discovers that you have been using a tax avoidance scheme, you could face possible fines and you will be required to pay back all of the tax that HMRC deems you to owe.

2019 Loan Charge

The 2019 Loan Charge grants HMRC the ability to punish contractors retrospectively for using disguised remuneration agreements dating back to 1999. Disguised remuneration schemes were recommended by many payroll providers and agencies at the time and involve an employee being paid indirectly through a third-party company in the form of an offshore intermediary.

What should you do if you are currently using a tax avoidance scheme?

If you think you might be using a tax avoidance scheme or may have used one in the past, you need to withdraw from it immediately. You should also report it to HMRC. This will avoid any further penalties or additional interest being charged.

If you would like any further information about tax avoidance schemes please visit the Churchill Knight Umbrella’s blog. Additionally, HMRC’s website also has plenty of information.

The dangers of using a non-compliant payroll provider (non-compliant umbrella company)

The 2019 Loan Charge was introduced as a way for HMRC to recoup tax that has been avoided by contractors who have used disguised remuneration schemes as far back as the 6th April 1999.

What is a disguised remuneration scheme?

A disguised remuneration scheme involves an employer paying a worker indirectly through a third-party company (umbrella company), often in the form of an offshore trust. Often the worker would receive a small amount of their salary which would be liable to tax and National Insurance Contributions and the rest would be paid via a loan or some other non-taxable distribution which disguises the payment of income. These loan schemes were recommended at the time by many payroll providers.

The 2019 Loan Charge

The government announced in the 2016 Budget that it would apply a tax charge to any outstanding disguised remuneration loans. HMRC has announced that it is aware of 50,000 workers who have used disguised remuneration schemes and, in some cases, up to two decades worth of tax bills are owed.

What happens if HMRC believes you have been using a disguised remuneration scheme

It is likely you will have to pay back all of the tax that HMRC believes you owe as well as additional penalties in the form of late payment interest. You may also be found to owe National Insurance and Inheritance Tax and will have to pay it back where applicable. All loans will be lumped together and taxed at the current rate instead of the rate at the time you entered into the loan.

You can settle your tax affairs

If you are currently using a disguised remuneration scheme or have used one as far back as the 6th April 1999 you have the option to settle your tax affairs before the 5th April 2019. You should contact HMRC immediately as it may be possible to reach a settlement agreement before the Loan Charge is introduced.

This is only applicable until the 6th April 2019 when the Loan Charge is introduced and you should seek legal advice after this time.

Settlement terms could include:

- Late payment interest – which can be applied to all years where HMRC has enquired, or may currently be enquiring, on your tax affairs.

- Income tax on the combined net amount of all the disguised remuneration loans you used.

- Inheritance Tax and other penalties where applicable.

- NICs if you are or were a self-employed contractor.

How to settle your tax affairs before the Loan Charge is implemented:

- Register to settle your tax affairs – If you choose to settle, your income that you earned whilst using a disguised remuneration scheme will be taxed by the rates used in the relevant years, rather than being taxed at the current rate of tax.

- Repay the loan before the charge is implemented.

- Churchill-Knight-Umbrella-Non-Compliant-Payroll-Providers

Seek advice

If you think you will be affected by the Loan Charge and want to fully understand your options it is advised that you seek legal advice. There are specialist law firms and tax experts who can provide you with the appropriate guidance.

The advantages of using an umbrella company

Choosing whether to set up your own limited company or sign up to an umbrella company can be a difficult decision to make, especially if you are new to contracting and are unsure which is the more suitable option for you. Umbrella companies are the easiest way for contractors to get paid and it is extremely easy to get set up and ready to go.

Continue reading to discover the advantages of operating through an umbrella company, and to gain a better understanding of whether it is the right option for you.

Advantages

- You only pay the umbrella company margin for the weeks that you work. When you are not working, you do not have to pay. Whereas working through a limited company you would have to pay your accountant regardless, although it may be a reduced fee.

- Registration is simple and you can sign up over the phone or via an online form in a matter of minutes.

- No joining fees, exit fees or tie in periods.

- If you are working on a short-term contract, working in the public sector or are receiving an hourly rate of £15 or less, an umbrella company is possibly the best option for you!

- You may be required by your end client or recruitment agency to use an umbrella company.

- Working through an umbrella company will give you a full payslip history where everything is seen as a salary and can be provided as references for credit e.g. loans or a mortgage.

- Most legitimate umbrella companies offer Professional Indemnity insurance, as well as Public Liability insurance and Employers Liability insurance – for free!

- If you are unsure whether contracting is for you, or if you are just starting out as a contractor, working via an umbrella company offers a low-risk way to try it out. You can form a limited company at a later date or return to full-time employment – depending on what you want to do.

- There is very little ongoing administration, as the umbrella company takes care of most of it, including invoicing and processing payroll. All you have to do is complete and send your signed timesheets (and expenses if applicable) to your umbrella company or recruitment agency.

- Continuity of employment – if you are working multiple contracts alongside each other you will be still be seen as one employee of your umbrella company and therefore your tax code won’t be affected and you won’t be overtaxed.

- Umbrella companies can be used for any industry, contract role or level of experience.

- When you sign up to an umbrella company you will get statutory benefits similar to permanent employees – Paternity Pay, Maternity Pay, and Sick Pay.

The disadvantages of using an umbrella company

Whilst there are plenty of advantages to operating through an umbrella company, unfortunately, there are also a few disadvantages.

Disadvantages

- When you work through an umbrella company all your income is paid as a salary and the umbrella company will deduct Income Tax, NICs and their margin. Therefore, umbrella companies do not have the same tax benefits that limited companies do.

- Working through an umbrella company gives you less control over your financial affairs compared to if you were a director of your own limited company.

- There are a lot of dodgy umbrella companies around that claim you can retain up to 90% of your salary, even after tax and NI deductions have been made. Beware – these are tax avoidance schemes and could get you in a lot of trouble with HMRC if you use them.

- You are not able to claim expenses through an umbrella company because HMRC have put in place rules to restrict expenses. HMRC felt that since permanent employees cannot claim tax relief on expenses, neither should umbrella workers.

- Speak to us if you would like to learn more about HMRC’s stance on claiming expenses through an umbrella company, and Churchill Knight Umbrella’s policy regarding this. Call us on 01707 871622.

What is IR35 legislation?

IR35 legislation was introduced in 2000 by HMRC to try and stop temporary workers avoiding tax by operating through an intermediary, such as a limited company (personal service company). To put it simply, HMRC deemed some limited company contractors and freelancers to be guilty of tax avoidance because they were taking advantages of tax benefits that were not entitled to employees in full-time employment.

Who assesses whether a contract is inside or outside IR35?

If you work in the public or private sector, your end client is responsible for determining your IR35 status and will issue a Status Determination Statement which explains the reasons for the determination. If you are inside IR35, the fee-payer (usually the umbrella company or recruitment agency) will process your tax deductions and pay these to HMRC. You will receive a net payment each week/month for the assignment. If you are outside IR35, you can continue to operate via a limited company and get paid gross for the contract.

Does IR35 apply to umbrella contractors?

If you are registered to an Umbrella Company, IR35 does not apply because you are an employee of the umbrella company and receive income through PAYE. This means you are paying tax and National Insurance like a full-time employee. Providing your chosen umbrella company is compliant (like Churchill Knight Umbrella), you have nothing to worry about!

Off-payroll legislation (private and public sector)

Off-payroll in the public sector came into effect in April 2017 and was rolled out to the private sector in April 2021. The changes had a significant impact on contractors, freelancers, private and public sector businesses and recruitment agencies.

What does off-payroll in the private sector mean for contractors and freelancers?

Since April 2021, private sector organisations are required to determine the IR35 status for each of their temporary workers. This must be done on a contract-by-contract basis for each new temporary worker they wish to engage.

Will I need to use an Umbrella Company after April 2021?

It depends on your IR35 status determination – if you are outside IR35 you can operate via a limited company and get paid gross for that assignment. However, if you are inside IR35 it may be more beneficial to use an umbrella company for your assignments.

Off-payroll in the private sector – is this bad news?

If you take on new contracts after April 2021 which deem you to be inside IR35, your take home pay retention (%) may decrease compared to contracts you have worked on previously that have been outside IR35. However, it isn’t all doom and gloom and you can always negotiate your rate to combat a potential decrease in take home pay.

After April 2021, it may be in your interest to use an umbrella company so that you receive your pay without any confusion and with the correct, legal deductions made to HMRC on your behalf. This will allow you to focus on your assignment, without having to worry about the complications that can arise when running a limited company.

Remember, you can opt to keep your limited company running in a dormant state, meaning that you can use an umbrella company for your contracts inside IR35, and use your limited company for contracts outside IR35.

What should you do if you have a limited company?

If you have a limited company you can still use this for contracts that are outside IR35.

Moving forward, it is in your interest to:

- Ensure your client gives you a fair IR35 assessment

- Negotiate a fair rate that you are satisfied with, after your IR35 assessment

Do I need to submit a self-assessment tax return if I use an umbrella company?

What is a self-assessment tax return?

A self-assessment tax return (or Form SA100) is HMRC’s way of assessing how much Income Tax and National Insurance Contributions (NICs) you are due to pay. As an umbrella contractor, your tax and NICs will already have been sent to HMRC on your behalf (PAYE). However, if you have any additional forms of income you will need to report this in a tax return as they will most likely be untaxed.

Here are a few reasons why you may need to complete a Self-Assessment Tax Return:

You qualify as a higher rate payer of tax

If your total annual income exceeds £150,000, you may have a higher/additional rate tax to pay that has not been already collected through your tax code.

You receive foreign income

Foreign income may be liable to UK tax and therefore if you are a UK resident taxpayer earning foreign income, you may be required to complete a tax return.

You have income from properties, savings or investments (including pensions)

If you receive rent or income from properties in the UK or income from savings or investments you will need to complete a tax return.

You have received payments which were untaxed

If you have sold or given away an investment or property you may need to complete a tax return and the Capital Gains Tax page (as Capital Gains Tax is due). Capital gains tax may be due depending on how long you have owned the asset and what gain has been made.

You have income from settlements, trusts or estates

If you receive income from annual trusts, settlements, or inherit the estate of a deceased friend or relative, you must return a self-assessment as tax will be due on this income.

You or your partner receive Child Benefit and your income exceeds £60,000

You may have to pay the High Income Child Benefit Charge if you or your partner have an individual income that’s over £60,000 and either:

- you or your partner get Child Benefit

- someone else gets Child Benefit for a child living with you and they contribute at least an equal amount towards the child’s upkeep

How to complete your Self-Assessment Tax Return

If you have not previously completed a tax return, you will need to register online first.

You will need the following information to complete your self-assessment:

- National Insurance Number

- 10-digit Unique Taxpayer Reference (UTR)

- Details of all the untaxed income for the tax year

- P60 or any other accepted records which show income you have received which has already had the tax applied

- Evidence of expenses relating to self-employment

- Contributions to pensions or charities which could be eligible for tax relief

There are two types of self-assessment tax returns – The standard SA100 form or the short version – SA200. You will only have to complete SA200 if it is sent to you by HMRC, otherwise, a SA100 will be required.

You will be told how much tax and NICs you are due to pay once you have completed your self-assessment tax return.

All the information you may need as well as the self-assessment forms can be accessed on the government’s website.

When is the deadline for the self-assessment?

You must complete your self-assessment tax return after the end of the tax year (5th April) for income earned in that tax year. The deadline for an online return is the 31st January the following year. The deadline for paper returns is slightly earlier and must be submitted by 31st October of the same year.

Penalties for missing the deadline

If you submit your tax return even one minute late you could face a penalty of £100, and it will continue to increase after this time. Interest is also charged on late payment of tax due. It is possible to appeal against a penalty if you submit your tax return after the deadline and have a reasonable excuse for doing so. Further information on how to appeal a penalty and what is considered by HMRC as a reasonable excuse can be found on the government’s website.

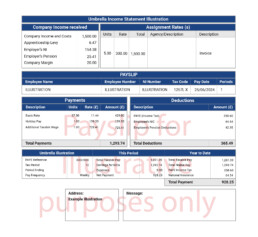

Understanding an umbrella company payslip

An umbrella company payslip can often be confusing and many contractors find it challenging to understand the deductions that have been made.

The following guide will provide you with a detailed explanation of a compliant payslip from an umbrella company. We will explain all of the deductions.

Umbrella Company Payslip

When you start contracting through an umbrella company, you become an employee of that umbrella company. This means you will receive a monthly payslip which will show your salary prior to any tax deductions, your salary after tax deductions, the fixed deductions and the variable deductions (tax and NI contributions).

Having a full payslip history is beneficial to you as a contractor as it can be provided as references for credit, loans or a mortgage.

You will notice on your payslip that Employers NI and Apprenticeship Levy deductions have been made. In permanent employment, the company you are working for is liable to pay these contributions. However, whilst the umbrella company is seen as your employer (for tax purposes) they are not benefitting from any of the work you carry out. Therefore, these deductions are taken from the assignment rate which is the agreed rate for the assignment or project which includes your gross rate of pay (the amount you are due to be paid) as well as the uplift for the employment costs. These deductions should not eat into your take home pay as your recruitment agency should uplift your salary (if you are offered the option of working through an umbrella company). This is to take into account the deductions for the Apprenticeship Levy, Employers NI, holiday pay and employers pension deductions (if applicable).

An umbrella company payslip will include the following sections:

Payments

This section will outline your salary, holiday pay and any additional payments such as overtime, maternity or sickness pay. It is a legal requirement for umbrella companies to pay you holiday pay so a proportion of your salary is either allocated as holiday pay or is accrued (on your request) and paid to you in a lump sum at a later date.

Holiday

It is worked out at 12.07% of your hourly rate. Most contractors choose to have their holiday pay paid to them along with their salary each week. However, it is possible for umbrella companies to accrue your holiday and give it to you in a lump sum at a later date. Some contractors see this as a way of helping to save for a small fund for a rainy day or planned holiday.

Deductions

This section will show all the Income Tax, NI contributions and pensions payments (if you are paying into a pension scheme) that will be deducted from the current pay period.

This Period

You will be able to see your Total Gross Pay (salary before deductions) and how much tax is being deducted from your salary.

Net Pay

Net pay is the salary (after deductions have been made) that you can expect to be paid directly into your bank account.

Year To Date

This shows you the total amount of tax you have paid to date, along with your Gross Pay.

Example of an umbrella company payslip

Explanation of deductions

Here is an explanation and breakdown of the deductions you can expect to see when you get paid via an umbrella company.

- £1500.00 is the company income received which is also referred to as the assignment rate. The assignment rate is the rate paid to the umbrella company by your end client or recruitment agency. It is the agreed rate which includes your gross rate of pay and the uplift for the employment costs multiplied by the hours you have worked that week.

- The company costs (Employers NI, Margin, Apprenticeship Levy and Employer Pension Deductions) will then be deducted from the assignment rate which leaves the contractors gross rate of pay – £1500.00 – £206.26 = £1293.74

- £1293.74 is the gross rate of pay which employee tax deductions are taken from (PAYE (Income Tax, Employees NI and Employee Pension Deductions) – £1293.74 – £365.49 = £928.25

- £928.25 is the net payment which will be paid into your bank account.

- As an employee, you are entitled to holiday pay. Similarly to other employment costs, this money is taken from the assignment rate. You can choose whether to have your holiday pay paid to you each payday (as this example shows) or have it accrued and paid in a lump sum at a later date. In this example, holiday pay is paid out and is £139.33.

Please note, if you opt out of the workplace pension scheme, you will not have any deductions for pension on your payslip. Additionally, if you are paying back a student loan, these deductions will appear and be accounted for.

Umbrella company - frequently asked questions (FAQs)

Why am I paying into a pension?

It is a legal requirement for all employers (including umbrella companies) in the UK to provide and enrol employees into a workplace pension scheme. If you do not want to use the pension scheme, you can opt out after you have been enrolled.

Why am I paying two lots of National Insurance Contributions (employers and employees)?

The short answer is – you are not. You only pay Employees NICs and this is taken from your gross rate of pay along with Income Tax deductions. Employers NICs are taken from the assignment rate. The assignment rate is the amount that you are paid for a specific assignment or contract, while the gross rate of pay is the total amount that you earn before any deductions are made. An assignment rate includes your gross rate of pay along with an uplift for the additional employment costs (Employers NIC, Apprenticeship Levy etc.).

Your recruitment agency should uplift your rate to cover these additional deductions. A full breakdown of the uplift, deductions and what you are due to be paid is shown on your payslip.

Why doesn’t my pay match the illustration I was given?

The illustration is only an estimation and should only be used as a guideline to show you how much you could take home. As an umbrella company, we can never give you exact figures as we do not have your tax code information or any information about how much tax you have already paid this year.

Why am I paying so much tax?

If you haven’t sent in a P45 then you will be put on an emergency tax code until you send in your P45. HMRC could also have sent us a tax code to use and if you think this is incorrect you need to ring HMRC to change it.

Where’s my payslip?

You can access your payslips at anytime via the online portal and they are also emailed to you.

What time will I be paid?

Once funds have been received from your recruitment agency, we are able to process it and you will receive a text letting you know when you have been paid. We operate Same Day Faster Payments to ensure you receive your pay without delay.

Why is holiday pay showing on my payslip?

It is a legal requirement to show holiday pay on your payslip. You can choose to have it paid out each week alongside your normal salary or accrued and paid at a later date.

Why use Churchill Knight Umbrella?

Setting the standards

We're one of the most recognised umbrellas in the UK.

Excellent processes

We've streamlined the sign up process. Support is always available.

Accurate pay calculations

Our calculations are based entirely on your circumstances.

A big network

We have excellent relationships with the biggest agencies.

Brilliant reviews

We have great reviews on both Google and Trustpilot.

Accredited by the FCSA

Churchill Knight Umbrella is a member of the FCSA.

Accredited by SafeRec

We are one of the first SafeRec certified umbrellas.

No hidden costs

You can use our service with complete peace of mind.

Employee benefits

Including Sick Pay and Maternity/Paternity Pay.

Continuity of employment

This makes it easier for you to get external finance.

Insurance

£25 million insurance cover is include in our service.

Same Day Faster Payments

You will receive your funds the same day we pay you.

Related Posts

21 January 2025

Becoming a first-time contractor in 2025

With the new year now in full motion, many workers are looking to explore new…

3 January 2025

Economic Review December 2024

As we enter 2025, this article provides an overview of the UK's economic…

17 December 2024

Opening hours during the festive period

We will operate as usual until the end of Christmas Eve (24th December, 09:00 –…

Disclaimer

This webpage is being provided to you solely for your personal information. It is not intended for distribution to the press or any other media and may not be reproduced or redistributed by mail, facsimile, electronic or computer transmission or by any other means to any other person or body without the express written permission from a Director of Churchill Knight Umbrella Limited.

This document is not a substitute for specific legal, accounting or other professional advice or opinions on related matters and issues that arise and should not be taken as providing specific advice on any of the topics discussed.

The information contained herein has been prepared by using sources believed to be reliable. Whilst reasonable care has been taken to ensure that the facts stated herein are accurate, no representation or warranty, express or implied is made by Churchill Knight Umbrella Limited, with respect to completeness, correctness, reasonableness or accuracy of any information and opinions contained herein.

Without limiting the generality of the foregoing, liability for any negligent or innocent statement or misstatement in respect of the contents of, or any omission from this document are hereby expressly excluded. Churchill Knight Umbrella Limited has no obligation or liability whatsoever with respect to the information provided or any action or inaction of Churchill Knight Umbrella Limited or the recipient with respect to such information.