Everything you need to know about umbrella calculations

Before registering with an umbrella company, it’s a great idea to request a tailored take-home pay calculation. While it may be tempting to opt for the umbrella company that offers the highest take-home pay, it’s important to understand how umbrella company calculations are formulated so you know whether or not the information is accurate and whether the umbrella company you are considering using is compliant.

Churchill Knight Umbrella will always provide an accurate umbrella company calculation based entirely on your circumstances. However, some umbrella companies have been known to offer misleading calculations to persuade contractors to register with their service. We’ve created a short guide to help you understand umbrella company calculations and why they may differ between providers.

What have we included in our umbrella company calculations guide?

Before requesting a take-home pay calculation from an umbrella company, there are a lot of factors you need to consider to ensure you understand the information presented to you. Please keep reading to learn more about umbrella company calculations. We have split our guide into six sections, to help you navigate it efficiently.

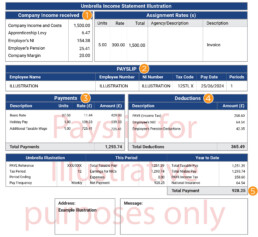

Example with explanations for deductions

Why do umbrella company calculations differ between providers?

Will my take-home pay differ from the calculation

Tax code

Tax avoidance schemes

Expenses

Example with explanations for deductions

Example calculation

What is the assignment rate?

The assignment rate is the rate paid to the umbrella company by the recruitment agency or end client. It is the agreed rate (including your gross rate of pay and uplift for employment costs) multiplied by the hours you have worked. The rate is the agreed day or hourly rate, and the units are the number of days or hours you’ve worked.

1. Company income received

The company income is the assignment rate the umbrella company will receive from your recruitment agency or end client. From the assignment rate, the umbrella company will make deductions for the following amounts:

- Apprenticeship levy – 0.5%

- Employers National Insurance – 13.8%

- Company margin – this will be the weekly or monthly amount

- Employers’ pension deductions (if applicable) – 3%

2. Payslip

This section includes essential information such as your name, National Insurance number, tax code, and the date you will be paid.

3. Payments

Many compliant umbrella companies may pay the National Minimum Wage rate (basic rate) for all hours worked and make up the rest of your rate with an additional payment such as a bonus or additional taxable wage. It is important to note that tax is still due on this payment, and all calculations must show all the hours you are expected to work alongside the total amount of tax due.

This section also lists payments for holiday pay at 12.07% of your taxable income. This calculation shows holiday pay as being paid out, which is the option most contractors choose. However, if you would like to accrue your holiday pay, please let the umbrella company know so they can adjust the calculation.

4. Deductions

The personal tax deductions that will be made to your gross rate of pay are shown in this section. The amount of PAYE (income tax) you must pay will depend on the amount you earn. The 2024/25 income tax rates are:

- The basic tax rate of 20% is applied to earnings up to £37,700

- The higher tax rate of 40% is applied to earnings from £37,701 to £125,140

- The additional tax rate of 45% is applied to earnings above £125,140

Employees National Insurance rates for the 2024/25 tax year are:

- 8% on earnings above the primary threshold of £12,570 per year to the upper earnings limit

- 2% on earnings above the upper earnings limit of £50,270 per year

If you decide to use the umbrella company’s workplace pension scheme, employee pension deductions of 5% will be listed in this section. Student loan deductions, if applicable, will also be listed here.

5. Total payment

This section shows the net payment, which is the amount you can expect to be paid each week or month.

Why do umbrella company calculations differ between providers?

Tax deductions

Umbrella company calculations should clearly show all the deductions that will be made and from where. The umbrella company will receive the assignment rate from your recruitment agency or end client and will make the following deductions to the assignment rate:

- Umbrella company margin

- Employer National Insurance Contributions

- Employer workplace pension contribution (this will not be present if you do not want to use the workplace pension scheme and ask for it to be removed from the calculation)

- Holiday pay

- Apprenticeship Levy (if applicable)

The assignment rate and employment cost deductions listed above will usually be displayed in a separate part of the umbrella company calculation to your gross rate of pay and personal tax deductions. The gross rate of pay is the wages payable to you before tax deductions. From the gross rate of pay, the umbrella company will make the following deductions:

- Income tax

- Employee National Insurance Contribution

- Employee workplace pension contribution (this will not be present if you do not want to use the workplace pension scheme and ask for it to be removed from the calculation)

- Student loan repayments (if applicable)

- Other deductions you are legally required to pay

The remaining amount is your net take-home pay, which you could expect to receive each week or month. Compliant umbrella companies must legally make all the deductions listed above, and HMRC sets the amounts. If any of the deductions are missing from a calculation or the amounts differ from the rates listed on the government’s website, ask the umbrella company why. Sadly, not all umbrella companies are compliant, and using a non-compliant provider could land you in serious trouble with HMRC.

Churchill Knight Umbrella will always include all deductions in our umbrella company calculations to ensure we provide you with the most accurate and transparent take-home pay illustration. Churchill Knight Umbrella is also a SafeRec Certified umbrella company, which means that every time we process a payment for our employees, each payslip generated is audited, and all payments are cross-references with RTI sent to HMRC to check the payment is compliant and all legal deductions have been made. All employees of Churchill Knight Umbrella will be emailed a report each time they are paid, allowing them to check that they have been paid correctly and that there are no signs of malpractice or unlawful deductions.

Apprenticeship Levy

The apprenticeship levy is a tax UK employers pay to fund new apprenticeships. UK employers with a payroll of more than £3m must pay a flat rate of 0.5% of their annual pay bill towards the levy. The annual wage bill is the sum of all payments made to all workers operating via PAYE (including contractors working inside IR35) subject to Class 1 National Insurance Contributions. As umbrella companies employ many contractors, they will likely have payrolls greater than £3m in value and will meet HMRC’s criteria for the apprenticeship levy. The apprenticeship levy is an employment cost deducted from the assignment rate. However, you must look out for this deduction on an umbrella company calculation to ensure the provider you are considering using is making the correct tax deductions.

Pension deductions

After 12 weeks of employment, you will be enrolled in the umbrella company’s workplace pension scheme with the umbrella company’s chosen provider. As an employer, it is a legal requirement to enrol you into a workplace pension scheme if any of the following apply:

- You’re classed as a ‘worker’

- You’re aged between 22 and State Pension age

- You earn at least £10,000 per year

- You usually work in the UK – further guidance is available on the government’s website

You do not have to use the umbrella company’s workplace pension scheme and can opt out once you have been enrolled. However, not all umbrella companies will include pension deductions in their calculations, as many contractors opt-out. Therefore, it is important to ask the umbrella company you are considering using to include pension deductions in your calculation if you would like to use their pension scheme.

If your chosen umbrella company offers a pension salary sacrifice scheme and you are interested in using the service, it is important to ask them to provide a calculation that includes salary sacrifice deductions—if they haven’t already. Salary sacrifice is a great way to increase the amount you allocate to your pension pot, but it can decrease your salary. Therefore, it’s crucial to understand how salary sacrifice deductions will affect your take-home pay and if it is a viable option for you.

The number of weeks used in the calculation

The number of weeks used in umbrella company calculations may vary between providers, and it’s essential to check with the umbrella company what the illustration is based on before comparing take-home pay amounts. Please also be aware that some providers may adjust the number of working weeks used in the calculation to produce a higher take-home pay amount.

Additional deductions

Churchill Knight Umbrella will always ask if you are currently paying back a student loan because student loan deductions will slightly reduce your take-home pay. Make sure if you contact an umbrella company for a calculation, they take your student loan into account.

Holiday pay

Under the Working Time Regulations 1998, workers (including most agency, part-time, and zero-hours workers) have the right to at least 5.6 weeks/28 days of paid leave each year. When you work via an umbrella company, you benefit from holiday pay, which is calculated at 12.07% of your taxable income.

The most common payment method UK umbrella companies adopt to pay a worker’s holiday pay is ‘rolled up’ or accrued. Rolled-up holiday pay gets added to your weekly/monthly payslip. This means you are always up-to-date with your holiday entitlement. Alternatively, you can choose to accrue your holiday pay and have it paid to you in a lump sum at a later date. For example, if you had an upcoming holiday or planned time off. Your holiday pay must be deducted from the assignment rate (along with other employment costs) and then paid back to you.

It is essential that you only consider compliant providers who clearly show holiday pay on your calculation and are transparent about how it works. Some unlawful umbrella companies have been caught not paying their workers what they are entitled to in regard to holiday pay. Churchill Knight Umbrella is always transparent about the deductions to your pay and will always show holiday pay on our umbrella company calculations.

The abatement

The abatement of personal allowance occurs when your income exceeds £100,000, and higher earners will begin to lose their personal allowance by £1 for every £2 over the £100,000 threshold. Your personal allowance is wholly eliminated once your taxable salary reaches £125,000. Some umbrella companies will not include the abatement in your take-home pay calculation, giving you a higher projected take-home pay. However, regardless of your calculation, the abatement will be applied to your pay if you are above the threshold. When you get a calculation from Churchill Knight Umbrella, we will always include the abatement if it applies to you to ensure you’re given the most accurate projection possible.

The margin

The only thing that will differ between compliant umbrella companies and the deductions they make is the margin. HMRC sets all other deductions, and every compliant umbrella company will adhere to the required tax calculations and pay them to HMRC on your behalf. Therefore, when comparing umbrella company take-home pay illustrations, if there are significant differences between the tax calculations and your take-home pay, always ask the umbrella company how they have reached this calculation to understand whether the provider you are considering using is compliant or not.

Will my take-home pay differ from the illustration?

It is important to remember that whilst umbrella companies strive to make their take-home pay calculations as accurate as possible, they are just illustrative projections to give you an idea of what your take-home pay could be each week/month. However, as umbrella companies only receive your tax code, information about previous earnings, and the amount of tax you have paid in the financial year once you register, they cannot give exact figures.

Churchill Knight Umbrella wants to ensure you receive the most accurate calculation possible. Our calculator – powered by My Digital – is one of the most comprehensive. Variables such as your tax code, contract rate, amount of hours you work, and whether you would like your illustration to include pension deductions can be changed to generate a take-home pay calculation that is as close to your actual take-home pay as possible. To request a take-home pay calculation from Churchill Knight Umbrella, please call our expert team on 01707 871622. You can also complete the short form on our website, and a team member will contact you with your tailored take-home pay calculation.

Tax code

The tax code used to generate an umbrella company calculation will affect your projected take-home pay. Not many, but some umbrella companies use different tax codes to reduce the contractor’s liability and, as a result, increase their take-home pay projection. This is simply an unethical and misleading tactic to persuade contractors to register. The calculation provided by umbrella companies should show which tax code has been used – if it does not, you should always ask for your reference.

Churchill Knight Umbrella’s illustrations are based on a standard tax code of 1257L, which gives you a personal tax-free allowance of £12,570 for the 2024/25 tax year. However, if you know you are on a different tax code, please let us know, as we can change the tax code in the calculation to provide a more accurate take-home pay illustration. Additionally, if you are a Scottish taxpayer, please let us know; our calculators have a Scottish tax code option, which considers the Scottish allowances.

Tax avoidance schemes

Sadly, as the number of umbrella companies available has increased in recent years, so has the number of tax avoidance schemes targeting contractors. Compliant umbrella companies will process payments using the HMRC tax system – Pay As You Earn (PAYE). This means you’ll be paid your net salary after the umbrella has sent the appropriate tax deductions to HMRC on your behalf (income tax, National Insurance, etc.).

Tax avoidance schemes come in many forms and involve paying some of the workers’ salaries to them in the form of a grant, loan, share, or any other payment that is not taxed. They are also known to present contractors with calculations that will see them retain upwards of 85% of their money. This type of pay retention is entirely unfeasible and indicates that you won’t pay the correct tax.

Engaging in a tax avoidance scheme could have severe consequences, resulting in significant, life-changing penalties. Always make sure that the umbrella company calculations you request are processed with PAYE. We recommend that you read our guide on how to spot a tax avoidance scheme.

There are also plenty of useful resources available on the government’s website, where you can read more about tax avoidance schemes and how to spot their signs. The government has also released a list of current named tax avoidance schemes, promoters, enablers, and suppliers to watch out for.

Expenses

Supervision, Direction and Control (SDC) came into effect on the 6th of April 2016 to limit the number of contractors who could claim expenses. The legislation was introduced as HMRC found that many contractors working through umbrella companies took advantage of this tax relief when they shouldn’t. This is because permanent employees cannot claim tax relief on the cost of everyday subsistence or travel between their home and usual workplace. Therefore, HMRC believed that contractors working via an umbrella company operating similarly to permanent employees should not benefit from these tax breaks either.

When you use an umbrella company, it’s doubtful you can claim tax relief on travel and subsistence expenses due to SDC legislation. Unfortunately, some umbrella companies will include expenses in their take-home pay illustrations to make workers think they’ll be able to retain a higher percentage of their earnings than they actually will. No umbrella company can guarantee a contractor is eligible to claim any expenses from the initial consultation call, and including expenses in a calculation is a devious and unfair tactic to try and get contractors to register for the service.

Churchill Knight Umbrella will not include expenses in our umbrella company calculations; we believe this is misleading. We want to provide you with the most accurate take-home pay illustrations to enable you to make an informed decision about your payroll.

Why use Churchill Knight Umbrella?

Setting the standards

We're one of the most recognised umbrellas in the UK.

Excellent processes

We've streamlined the sign up process. Support is always available.

Accurate pay calculations

Our calculations are based entirely on your circumstances.

A big network

We have excellent relationships with the biggest agencies.

Brilliant reviews

We have great reviews on both Google and Trustpilot.

Accredited by the FCSA

Churchill Knight Umbrella is a member of the FCSA.

Accredited by SafeRec

We are one of the first SafeRec certified umbrellas.

No hidden costs

You can use our service with complete peace of mind.

Employee benefits

Including Sick Pay and Maternity/Paternity Pay.

Continuity of employment

This makes it easier for you to get external finance.

Insurance

£25 million insurance cover is include in our service.

Same Day Faster Payments

You will receive your funds the same day we pay you.

Check out our newest articles

21 January 2025

Becoming a first-time contractor in 2025

With the new year now in full motion, many workers are looking to explore new options for the next step in…

3 January 2025

Economic Review December 2024

As we enter 2025, this article provides an overview of the UK's economic performance in December 2024,…

17 December 2024

Opening hours during the festive period

We will operate as usual until the end of Christmas Eve (24th December, 09:00 – 17:30). However, during the…

13 December 2024

5 tips for nurses and healthcare professionals when engaging with an umbrella company

Umbrella companies are a popular method of payroll for nurses and healthcare professionals working on…

3 December 2024

Economic Review November 2024

Interested in keeping up to date with the latest economic performance information impacting businesses and…

14 November 2024

How will the rise in Employer’s National Insurance impact umbrella company employees’ take-home pay?

Chancellor Rachel Reeves announced in the Budget 2024 (Wednesday 30th October 2024) that the Employer’s…

7 November 2024

Churchill Knight Group enters exciting new chapter after acquisition

The Churchill Knight Group has been acquired by Magi GJJ – a group of business professionals with extensive…

31 October 2024

Budget 2024: The implications for recruitment agencies and their candidates using umbrella companies

The long-awaited Budget 2024 was delivered by Labour Chancellor Rachel Reeve in parliament on Wednesday, 30th…

31 October 2024

How will the increase in Employer’s National Insurance impact recruitment agencies and umbrella company employees?

On Wednesday, 30th October 2024, Chancellor Rachel Reeves delivered the first Labour Budget in over 14 years.…